ADXPivot XAUUSD

Financial freedom

with realistic mindset

ADXPivot XAUUSD made after:

7

billion

backtests

backtests

6

articles in

scientific journals

scientific journals

3

Years of

scientific research

scientific research

Realistic goals,

realistic returns

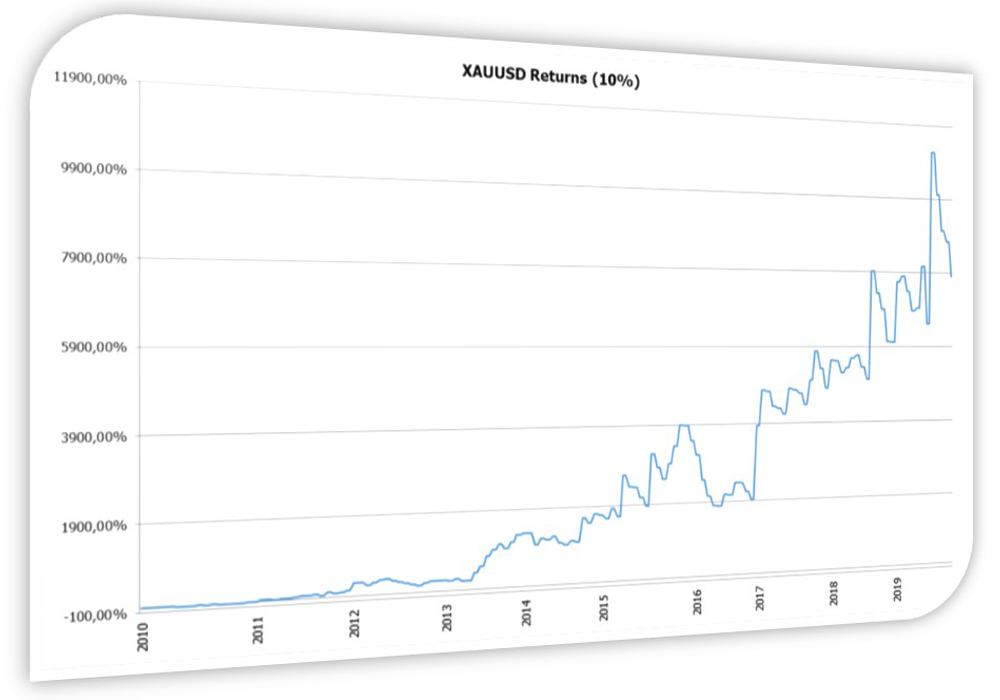

ADXPivot XAUUSD returns

54.8% annually

7,807% over a decade

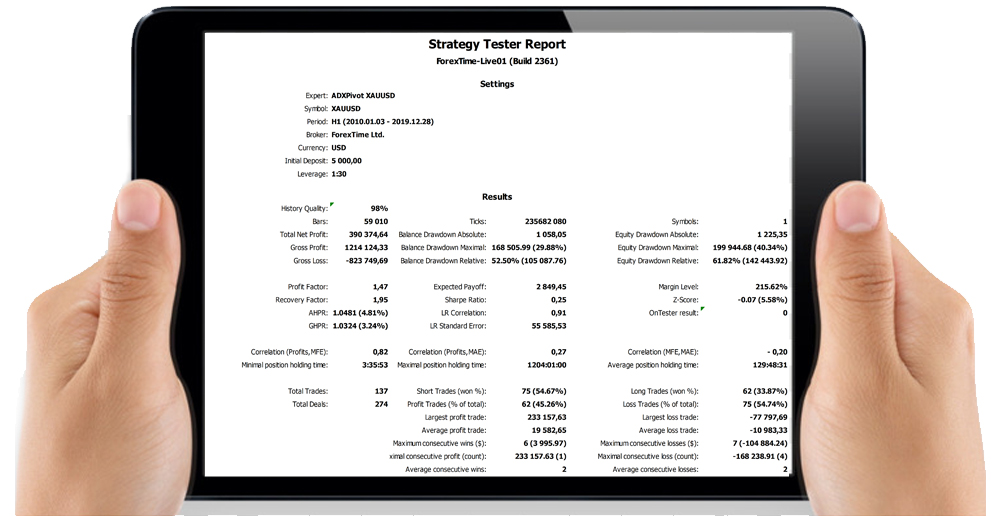

Strategy Tester Report

ADXPivot XAUUSD

Our strategy tests started with $5.000 initial deposit. The leverage was 1:30 and we used 10% of our bankroll to open positions. During the 10 year period, 137 trades were made, the profit factor was 1.47 and the net profit was $390,374.64.

No effort required

Fully automated

Expert Advisor

Up to 5 activations

Buy ADXPivot XAUUSD now

Let the robots grow your capital